Most budgeting apps focus on past spending. They tell you where your money went, but not always where it’s headed. That’s where BudgetCalendar comes in. Try it for free…

BudgetCalendar is built to answer a simple but powerful question:

👉 “What will my bank balance look like in the days and weeks ahead?”

How It Works

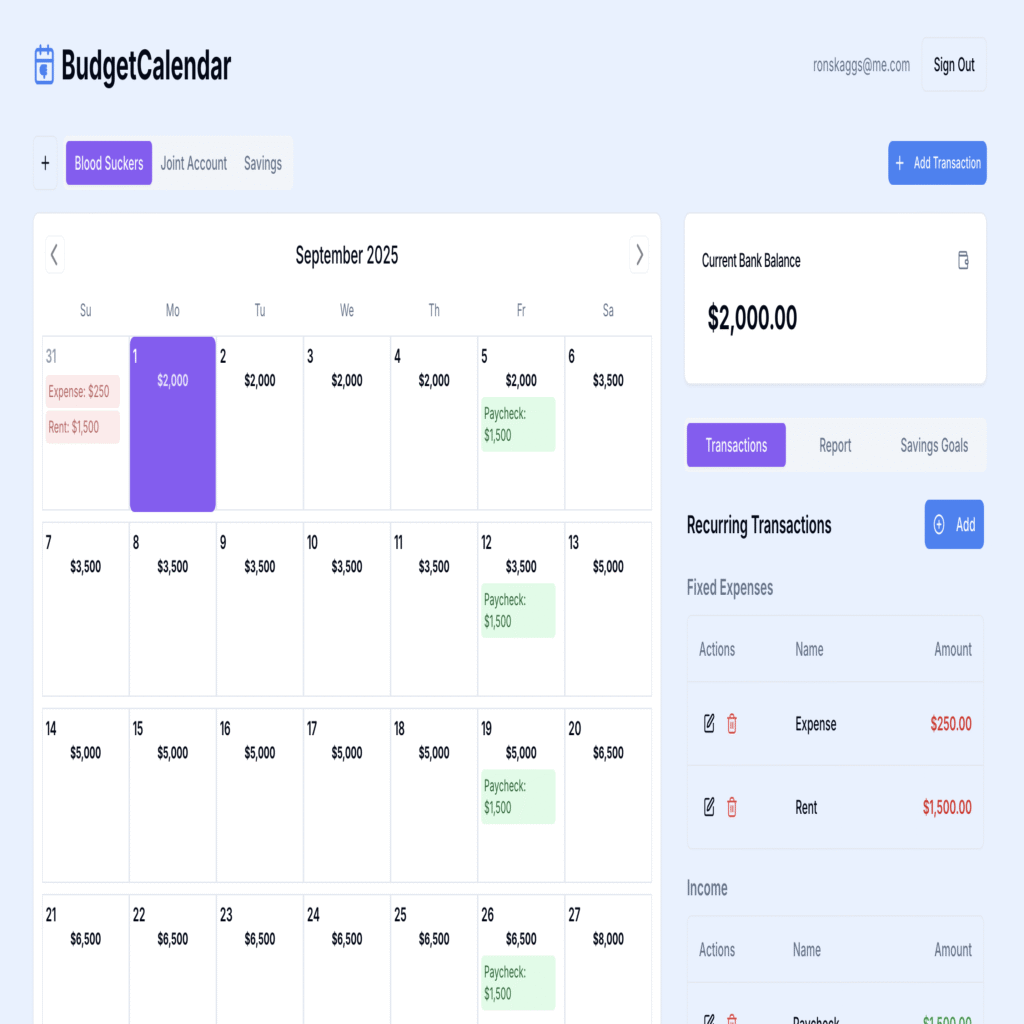

BudgetCalendar combines the clarity of a calendar with the practicality of a budgeting tool. Instead of long spreadsheets or confusing graphs, you get a daily view of your future balance.

Here’s how simple it is:

- Enter Your Current Balance – Start with what’s in your account today.

- Add Recurring Transactions – Income, bills, subscriptions, savings, and investments.

- Watch It Play Out – Instantly see how your balance changes on each day of the month.

The result? A crystal-clear picture of when your money comes in, when it goes out, and how much cushion you’ll really have left.

A Personal Note

For years, my wife and I managed our budget with a spreadsheet. Every month we’d type in income and expenses, update formulas, and cross-check everything. It worked, but it was a chore — and it always felt like we were one step behind.

Now with BudgetCalendar, updating our finances is as simple as entering today’s bank balance. The app does the rest, projecting the daily balances for the whole month. Even better, it highlights the lowest balance points, so we know when to be extra cautious.

I’ll be sharing this tool in beta. It’s free to try — I’d love your feedback on how it works for you and whether it helps you avoid overdrafts or low-balance stress.

Why It Matters

Too often, we find ourselves with “more month than money.” Unexpected expenses or bad timing can throw everything off. BudgetCalendar helps you spot those dips in advance, so you can adjust before it’s too late.

- No more surprises at the end of the month

- Confidence in planning savings and investments

- Peace of mind knowing what’s ahead

Budget + Calendar = Peace of Mind

BudgetCalendar isn’t trying to replace your financial advisor or your bank. It’s here to give you clarity. By blending budgeting with a simple calendar layout, it turns future balance tracking into something visual, easy, and even a little fun.

Whether you’re saving, paying down debt, or just trying to avoid overdrafts, BudgetCalendar helps you stay one step ahead of your money.